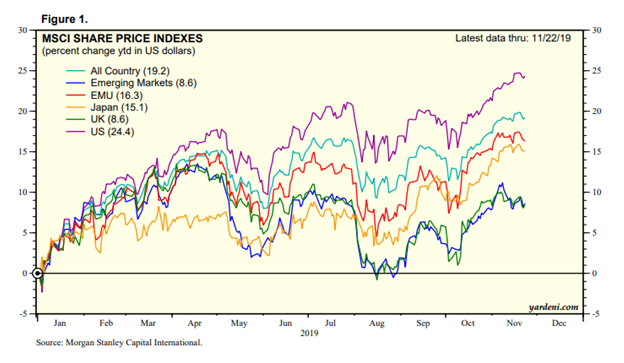

Stock Market has had a turbulent time in 2019 as indicated by the ups and downs on the graph below. Yet, in spite of much pessimism in the media, share prices keep on reaching fresh all-time highs and the lengthy bull market continues.

How long this can carry on remains to be seen. Some market commentators are voicing negative concerns that bull will turn to bear as we say hello to 2020. But they often do this at the end of a year. Google what the stock market forecasts were for 2019 in December 2018 and you will find dozens of examples of doom-mongering predictions which never came to fruition.

So my first piece of advice is to take everything you read with a pinch of salt.

Obviously market downturns rattle investors but should they? What should investors do when stocks start to plummet? Well, believe it or not, much of the time the answer is nothing. Remember that downturns are a natural part of the cyclical economic cycle so for those investing over the long term, the best plan of action, and my second piece of advice is to stay invested.

Take a look at this of the S&P 500 Stock Market where the general trajectory of the graph is upwards. Of course there are some troughs in there, most notably at the time of the 2008 financial crisis, but anyone who invested in any decade from the 1950s to the 2010s, even those unlucky enough to have done so just before the financial crisis, will have made gains over the long term. We can conclude that riding out the storms, rather than attempting the notoriously tricky task of timing the markets, is generally the best policy for investors with lengthy investment horizons. If you are nearing retirement, this may not apply to you and you should definitely seek professional advice.

My third piece of advice is to consider unit cost averaging as a useful tool if you are investing for the future. It means buying a fixed amount of a particular investment on a regular basis, regardless of price. That means that you will be buying more shares when prices are low and less when they are high, a policy which reduces the risk of mistiming the market with a single, large investment and smooths out the effects of short term fluctuations in share value.

Fourthly, I always advocate diversification. I’m not alone in this, of course, diversification is a basic investment principle widely recognised as key to managing risk. Investing across a broad range of asset classes in different sectors and geographical regions is another way to protect your portfolio against volatility. As market conditions change, different assets will react differently and should balance out each other’s ups and downs.

If you’d like some advice on how to employ the strategies above to bolster your investments, why not book an appointment to review your portfolio with me and pinpoint possible areas for improvem.ent? You can contact me at bmulder@infinitysolutions.com.

Recent Comments